Loan

-

How to get a business loan with bad or no credit

Navigating the world of business financing can be particularly challenging for entrepreneurs with bad or no credit. While traditional lenders often view credit scores as a primary indicator of risk, there are various options available that can help you secure the funding you need to grow your business. This article will explore effective strategies for

-

Digital loan fraud: how to protect yourself from scams

In an increasingly digital world, access to loans has become easier than ever, but this convenience also comes with a significant risk: digital loan fraud. Scammers are becoming more sophisticated, employing tactics that can deceive even the most cautious consumers. Understanding the various types of scams and recognizing the warning signs is essential for anyone

-

Loans for self-employed, freelancers & gig workers (2026 edition)

As the gig economy continues to expand and more individuals embrace self-employment and freelance work, understanding the landscape of loans tailored for this demographic has never been more critical. Self-employed individuals, freelancers, and gig workers often face unique challenges when seeking financial assistance, including fluctuating incomes and the need for robust documentation. In this 2026

-

How new repayment plans for student loans compare

Student loans continues to evolve and borrowers are now face with an increasingly complex array of repayment options designed to alleviate financial burdens. With the introduction of new repayment plans, understanding how these options compare to traditional and income-driven plans is crucial for informed decision-making. This article delves into the various student loan repayment plans

-

Student loan repayment changes Americans must know now

As the landscape of student loan repayment continues to evolve, it is crucial for borrowers to stay informed about the changes that directly affect their financial obligations. Recent legislative updates and policy shifts have introduced new repayment plans, adjusted deadlines, and revamped forgiveness programs that can significantly influence repayment strategies. Whether you are a recent

-

How to avoid loan defaults — tips from experts

The burden of loan repayment can become overwhelming, leading to loan defaults that can have long-lasting repercussions on one’s financial health. To navigate the complexities of borrowing and ensure timely repayments, it’s essential to understand the factors that contribute to defaults and adopt proactive strategies. This article compiles expert insights and practical tips to help

-

The risks and benefits of Buy Now, Pay Later (BNPL) vs traditional loans

In recent years, the Buy Now, Pay Later (BNPL) model has gained immense popularity as a flexible financing option for consumers seeking immediate gratification without the burden of upfront payments. While BNPL services allow shoppers to split their purchases into manageable installments, traditional loans have long been a staple for larger financial needs, providing a

-

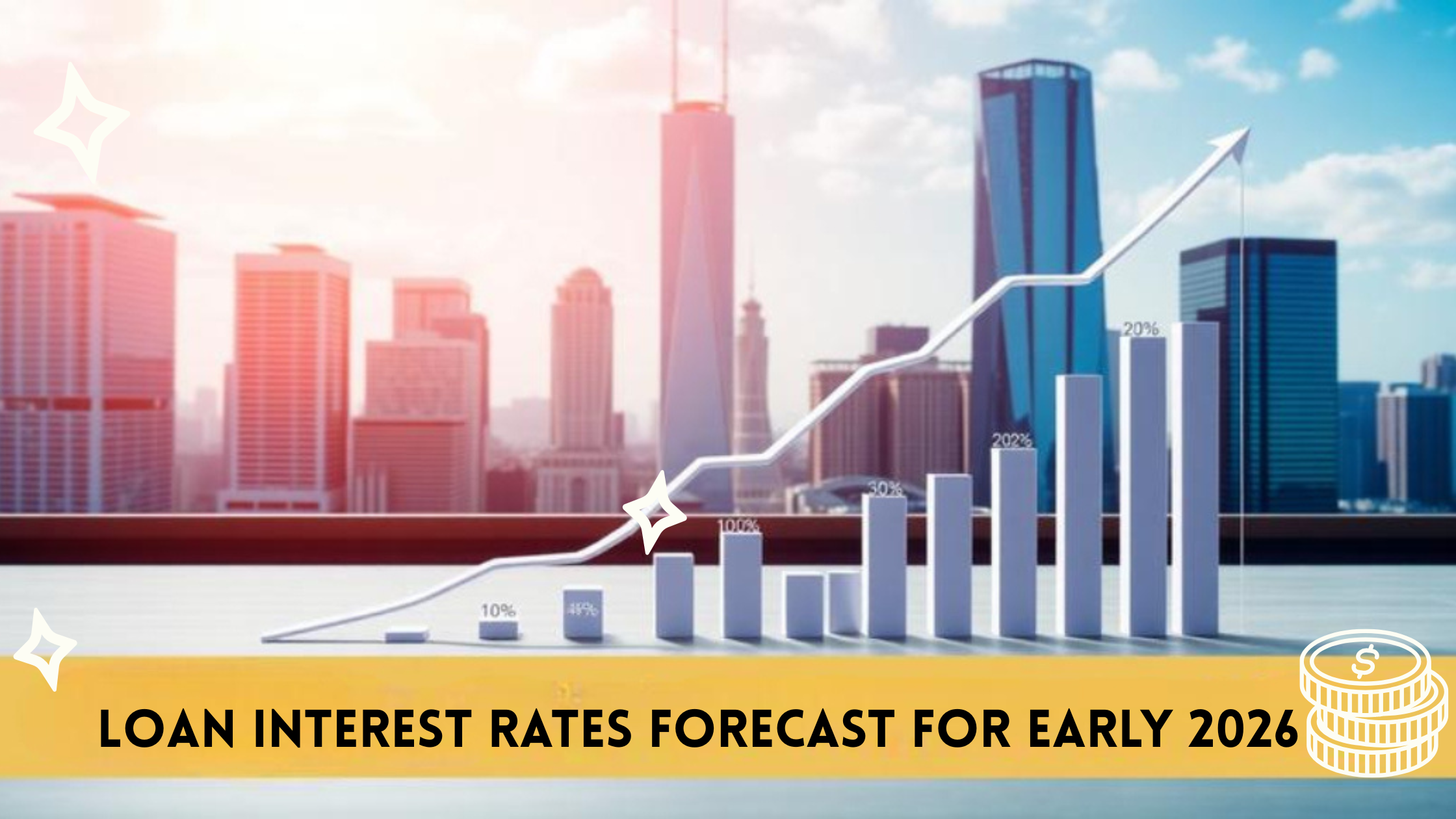

Loan interest rates forecast for early 2026

As we approach early 2026, understanding the forecast for loan interest rates becomes increasingly crucial for borrowers and lenders alike. With a myriad of factors influencing these rates, including economic indicators, monetary policy, and global events, potential borrowers must be well-informed to make strategic financial decisions. This article aims to provide a comprehensive overview of

-

How to improve your credit score before applying for a loan

Improving your credit score is a crucial step to securing favorable loan terms and interest rates. Whether you’re planning to buy a home, finance a car, or secure a personal loan, lenders will closely examine your credit history to assess your reliability as a borrower. With a few strategic actions, you can enhance your creditworthiness

-

Understanding FICO vs VantageScore in Loan Applications

If you are seeking loan it is very essential you understand the whole difference between credit scoring. Two of the most widely recognized credit scores are the FICO Score and Vantage score, each offering distinct methodologies and implications for loan applications. While both scores serve as critical indicators of an individual’s creditworthiness, they differ in

-

Best instant loan apps people trust in 2025

In 2025, the landscape of personal finance continues to evolve, with instant loan apps gaining unprecedented popularity among borrowers seeking quick and convenient access to funds. As financial technology advances, consumers are increasingly turning to these apps for their ease of use, speed, and flexibility. However, with numerous options available, it is essential to identify

-

How to qualify for the lowest interest loans in 2025

As we move into 2026, securing a loan with the lowest possible interest rates is more crucial than ever for individuals and families looking to finance significant purchases, such as homes or vehicles. With economic fluctuations, lending standards, and evolving market conditions, understanding how to qualify for these favorable rates can significantly impact your financial